Finance issues could plague draftees

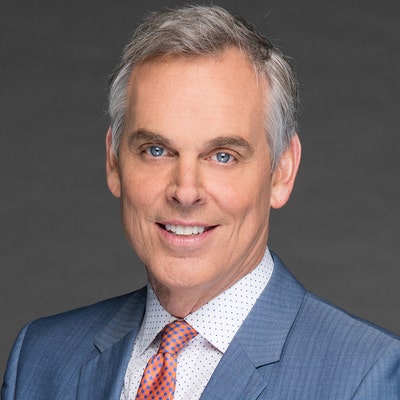

Terrell Owens' recent appearance on the "Dr. Phil" TV show was an uncomfortable reminder of what can happen when an NFL player doesn’t take care of his money.

But in that regard, Owens isn’t the only one in need of some counseling.

At the same time Dr. Phil and three mothers of his children were airing the wide receiver’s dirty laundry, most NFL clubs were finalizing contracts with incoming draft picks. A major change in the league’s collective bargaining agreement with the NFL Players Association has made this process far simpler than at any point in almost two decades. Because of a new slotting system that essentially eliminates salary negotiations, most franchises will get all of their newcomers signed well before the preseason begins in late July.

The good news: Rookie contract holdouts, especially among first-round picks, are basically extinct.

The bad news: There is a greater risk that another group of players will head down the same path that left Owens’ bank account in tatters.

Such is the danger of giving college-aged men huge sums of cash that they might not only be unprepared to handle but will receive more than two-plus months before training camps open.

With so much spare time on their hands, rookies will face temptations and pressures that could cause the kind of spending they will later rue. Those who are particularly susceptible generally come from impoverished backgrounds. These players seek the kind of material possessions they lacked growing up, such as jewelry or a new car. Some also spend excessively on friends and family to reward them for their support leading up to NFL careers that usually don't last as long as many players think they will.

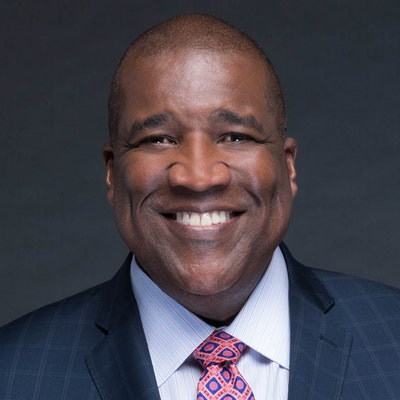

“This is going to be the first time the league is going to have to deal with the challenge of rookie players having a significant amount of money during the offseason,” said Kevin Winston, the Atlanta Falcons’ director of player programs. “It’s a real big deal.”

Unfortunately, plenty of players will have already made regrettable deals by the time Winston and his peers have the chance to meet with the incoming draft class.

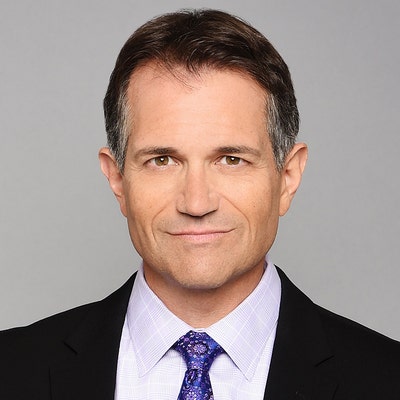

Troy Vincent, who is the NFL’s vice president of player engagement, told FOXSports.com that the league is barred from addressing prospects until after the college season has ended in January. Vincent said NFL commissioner Roger Goodell and NCAA president Mark Emmert have discussed a potential agreement that would allow the league to visit campuses earlier. This would enable the NFL to offer presentations designed to keep players from making major financial decisions until they are better informed about the consequences.

“Many men by that particular time had someone tell them where they’re going to be drafted,” said Vincent, referring to agents, financial advisers, marketing managers and their runners. “They’ve taken out loans and already made a home, vehicle or multi-vehicle purchase. Remember, we’re talking about January of their junior or senior year. Technically, they’re still student-athletes, but someone has already formed a relationship.

“By the first time we speak to them, we’re already dealing with a crisis.”

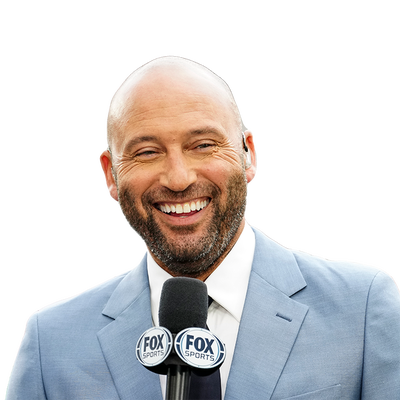

Vincent resisted temptation before beginning his 15-year NFL career. Although he was considered a top-10 prospect in 1993 (he was chosen at No. 7 by Miami), Vincent declined feelers about acquiring a pre-draft car loan. He was afraid of the message it would send to his mother about fiscal responsibility.

Vincent later participated in offseason programs to prepare for life after football. In 2003, he helped establish the NFL’s Business Management and Entrepreneurial Program with Wharton School of the University of Pennsylvania as an outlet for players to follow in his footsteps. Similar outreach programs are now in place with other premier universities like Harvard and Northwestern.

As it stands now, all 32 NFL teams and the league itself offer year-round financial services and programs designed to educate, protect and guide those whose greatest earning potential will come in their 20s and possibly 30s. The NFLPA has its own set of initiatives and is responsible for overseeing the registration of both player agents and financial advisers.

Yet even with all this in place, there are still players like Owens who fail to take advantage of the resources provided. Owens claims he lost much of his $80 million-plus in NFL earnings because of bad advice from financial advisers recommended by agent Drew Rosenhaus.

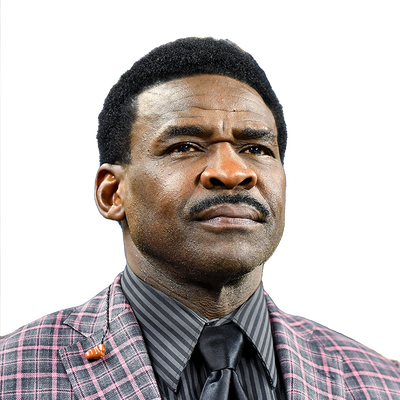

Former Tampa Bay and Oakland defensive tackle Warren Sapp filed for bankruptcy earlier this year and listed 240 pairs of Jordan athletic shoes among his assets. New York Jets quarterback Mark Brunell had earned $52 million in salary but filed for bankruptcy in 2010 after a series of failed real-estate and business investments and loans. Unsuccessful business ventures prompted Pittsburgh Steelers backup quarterback Charlie Batch to do likewise in 2011 despite having more than $20 million in career earnings.

A 2009 Sports Illustrated analysis revealed that 78 percent of the former players polled were bankrupt or experiencing financial difficulty within two seasons of leaving the NFL. A University of Michigan study from that same year reported that 48 percent of ex-players ages 30-49 and 45 percent ages 50 and over have at some point "experienced significant losses in business or financial investments."

Vincent said the league is doing extensive work to try to help today’s players avoid the same fate but also realizes there’s only so much that can be done.

“We can’t do any more,” Vincent said. “It’s really getting the athlete to take ownership of this area of his life. We give no financial advice. Our office is strictly based upon education, but you have to have an athlete who wants to engage.

“A lot of times the response is, ‘My guy is taking care of it.’ They’re putting it in someone else’s hands. Many are not looking to educate themselves at all.”

The NFL’s crash course begins each January with hour-long presentations at two college all-star games — the Senior Bowl and East-West Shrine Game. This year’s sessions included representatives from the Financial Industry Regulatory Authority (FINRA), which is the largest independent regulator for all US securities firms. FINRA warns players about the scams pulled by some financial advisers and provides information about how to conduct a vetting process.

“You see high-profile schemes where people have lost anywhere from tens of thousands of dollars to millions,” said Gerri Walsh, president of the FINRA Investor Education Foundation. “We try to arm (players) with information about the persuasion tactics that con artists tend to use.

“Investment fraud research has shown that while the pitch or the hook often changes, the persuasion tactics cons use tend to be the same. Those tactics are designed to break down an investor’s psychological barrier or, as the cons would say, put the investor ‘under the ether.’ The reason players might be targeted is in part because of their celebrity status. They’re perceived to have a lot of money. Cons go where the money is.”

A source told FOXSports.com that several incoming rookies were floated six-figure loans by agents and financial advisers based on their projected draft standing. Some agents front cash as a way to lure clients who often aren’t well-versed in financial management like many non-athletes their own age. Those same agents are also clamoring for quick completion of rookie contracts to begin recouping their investments.

Marketing deals for high-profile prospects allow those players to receive up-front money that is usually spent quickly. Financial advisers, who are often linked to agents, can provide loans or help players obtain a line of credit and credit cards. Those advisers might not provide a thorough explanation of interest rates or how borrowing money can impact a player’s financial future.

The player who suffers the most is the one who spent as if he were an early round pick before the draft but was instead chosen later. Guaranteed money in 2012 rookie deals will range from a projected $25 million for No. 1 pick Andrew Luck to roughly $45,000 for those selected late in the seventh round. A slide out of the first or second rounds represents losses well into the six figures.

Of the 100-plus prospects at the NFL’s college all-star game presentations, Vincent said, about one-third will “pull you aside” to discreetly ask questions because they realize a financial mistake might have already been made.

“Most of the feedback is, ‘There’s something you said in there about my investment team . . . ’ ” Vincent said. “They’ll then give you that look like, ‘I didn’t know this and it’s not going to work out well.’ I tell them not to panic and let’s just talk about it. Some of the intervention takes place there.”

The NFL, though, doesn’t meet with draft picks en masse again until its rookie symposium in late June. Because some colleges on an academic quarter system are still holding classes through May, Vincent said the league can’t schedule the symposium any earlier.

Thus, financial education in the weeks after the draft falls to individual teams. Each has a player-development department, but the quality of those programs and overall commitment varies from each franchise.

The Atlanta Falcons are regarded among the league’s best. The yearlong “Falcon U” program covers a swath of topics and features speeches by the team’s owner (Arthur Blank), general manager (Thomas Dimitroff) and head coach (Mike Smith). Winston said Atlanta’s rookie class will hear a presentation Thursday from nonprofit financial group Money Management International about how to create a budget, the tax bracket they are entering and “what is going to be thrown at you over the next 90 days.”

“Players have to get acclimated on two fronts,” Winston said. “There’s the football standpoint but also what happens when you relocate to a new city. These guys are going from having a structured environment with academics and football to one where their offseason work is done by 1 p.m. and the rest of the day is unstructured.

“For someone in my position, I need to get to know the guys and their financial needs. It all comes under the financial pressure that comes with being an NFL rookie.”

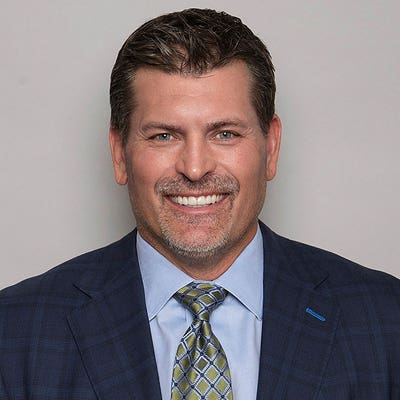

Harry Swayne, who is Baltimore’s director of player development, changed his offseason program because the Ravens got their entire eight-man draft class under contract so quickly. Of the 23 hour-long sessions he will conduct, those on financial management are now being offered first.

One of those features a car salesman espousing the pros and cons of purchasing a new vehicle, an experience about which Swayne knows all too well. As a 1987 seventh-round pick by Tampa Bay, Swayne said, he received a $20,000 signing bonus. Swayne remembers all the details of his first big purchase: a brand-new black Saab 900 turbo with silver trim and a tan interior.

The cost was $21,000. Swayne, though, didn’t care. Like many of today’s NFL youngsters, Swayne considered the vehicle as a symbol of social standing that indicated he “made it.”

What he really made was a money pit.

“I bought insurance on the payments,” Swayne recalled with a laugh. “I didn’t negotiate the price of the car at all. What was on that sticker, that’s what I bought it for. The other mistake I made was I didn’t call anybody like my agent to let him know that I was going through the process of buying a car.

“And, oh, yeah, I didn’t know how to drive a stick.”

One clutch and thousands of dollars later, Swayne met a Bucs veteran who had just paid off his car early. Swayne asked the player why he hadn’t just continued to make monthly payments. The answer: “It’s not cheap to borrow money.”

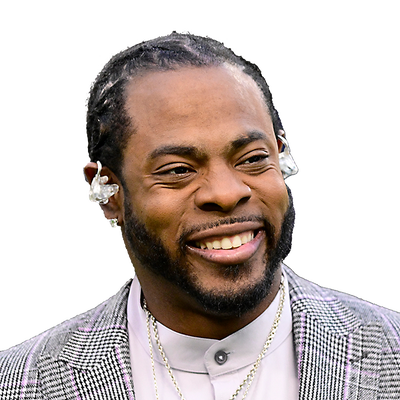

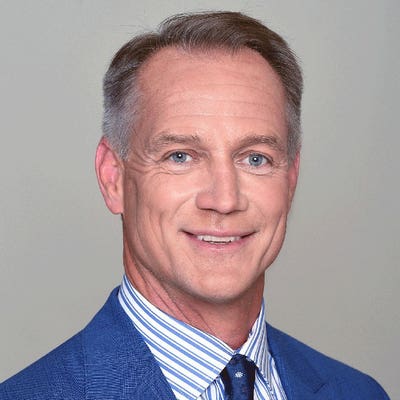

Cornerback/returner Brandon Boykin, a fourth-round pick in the 2012 draft from the University of Georgia, received a $405,000 signing bonus earlier this week when he signed with the Philadelphia Eagles. Thanks to admittedly being “cheap,” Boykin said, he has avoided any big-money purchases with none planned until becoming further established in the NFL. He also lauded the Eagles for offering financial services and advice from the moment he first reported.

“There have been people coming out of the woodwork as soon as they learn you’ve got a chance to make a lot of money,” Boykin said. “Fortunately for me, people I have in my corner like friends, family, my agents at Universal Sports and people already in the NFL who have prepared me for what to expect.

“I don’t have a problem saying no at all.”

Owens and some of his peers are paying the price for not having done the same.